Join the Best Workday Training in Bengaluru to Learn, Practice and Suceed

Workday Benefits Tutorial

Training Blueprint

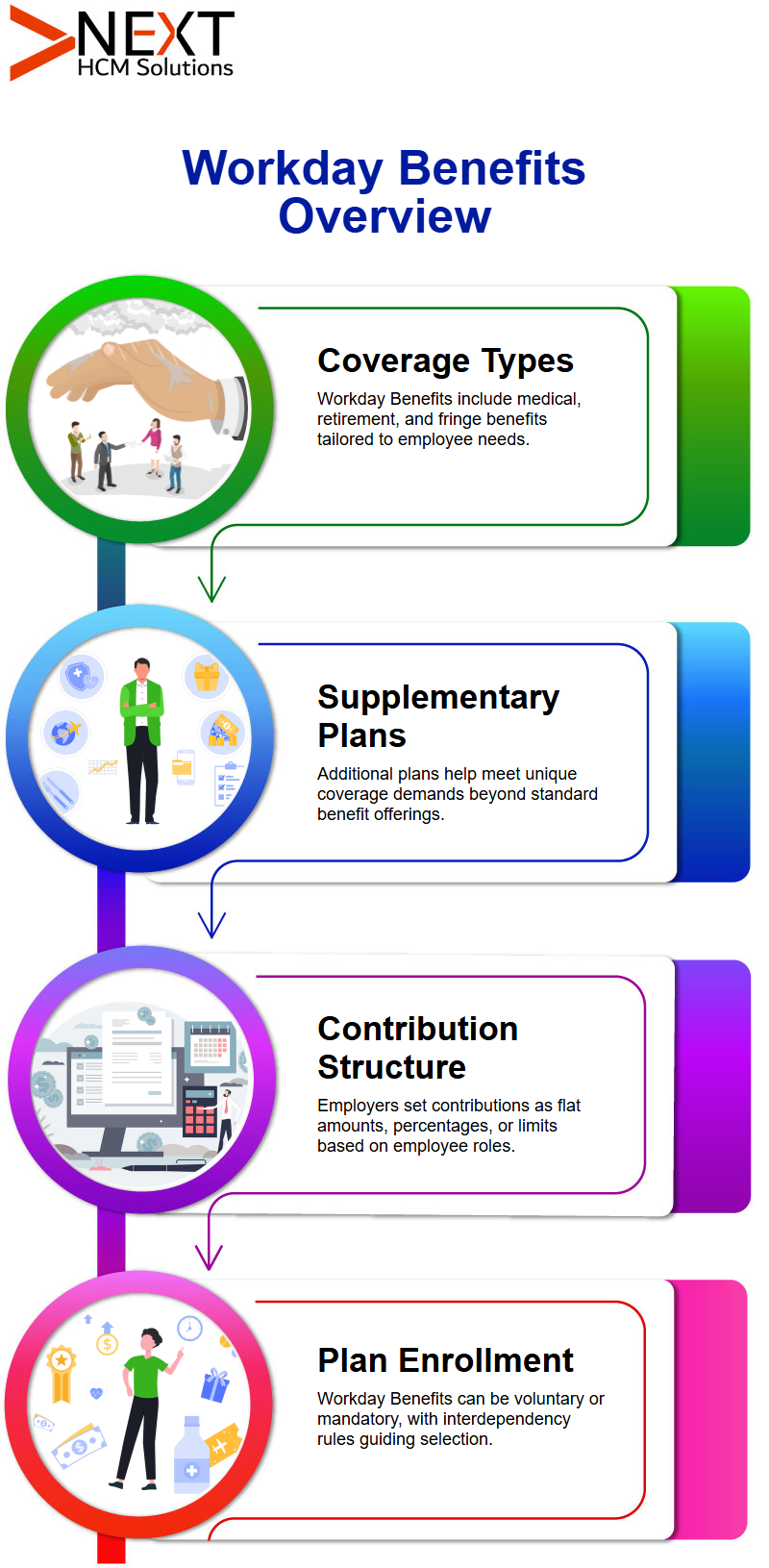

Overview of Workday Benefits

Let’s delve deeper into Workday Benefits and explore all the available plans, with a particular focus on retirement benefits.

When setting up a Workday Benefits program, we must establish standard mandates and select suitable coverage types.

Certain benefits, such as health savings accounts, are only available within the United States, while medical insurance and retirement benefits are universally accessible.

As clients sometimes request Workday Benefits plans that don’t meet their unique coverage needs, it becomes essential to create supplementary plans.

A Workday Benefits Tutorial in Bengaluru offers valuable insights into how to fulfil these specific client demands.

Employers and their employees share responsibility for any fringe benefits opted for by both entities, such as pet sitting services, gym membership fees, and cafeteria allowances, which are included as components of Workday Benefit plan.

Policy and Contribution Structure Summary for Workday Benefits

Workday Benefits contributions come in various forms; flat amounts, percentages, and minimum/maximum limits may all be taken into consideration when allocating benefits contributions to staff members.

Top-level staff could receive $200 while all other staff would only get $100 in benefits contributions.

Employers should determine whether Workday Benefits plans are voluntary or compulsory for employees. In either instance, auto-enrolment must take place only at the plan level.

Interdependency rules governing Workday Benefits determine whether multiple plans offering similar coverage types are allowed or not.

Employers should make sure their employees can easily select one of them without difficulty.

Cost and Eligibility Framework for Workday Benefits

Workers taking advantage of Workday Benefits may benefit from being informed about the costs associated with transparent upside plans.

Their employers cover all expenses related to gym memberships; no employee contributions are required.

Workday Benefits, as highlighted in the Workday Benefits tutorial in Bengaluru, provide employees with an efficient way to register benefits seasonally and help guarantee seamless distribution. Workday Benefits’ COBRA equipment offers excellent support for employees who have been laid off, but employers must ensure that all solutions are organised logically for optimal results.

End-to-End Workday Benefits Plan Setup and Integration

Once all parameters have been defined, we can go ahead with creating our Workday Benefits plan. Employers select providers while attempting to maintain consistent benefits across these options.

Employers must decide whether they wish to manage Workday Benefits contributions within or through an external application, with processes already in place allowing profit amounts from various systems to be automatically imported into Workday Benefits.

During the international segment of the Workday Benefits tutorial in Bengaluru, ensure that currency settings are correctly aligned with employee locations.

For instance, USD provides coverage of staff in the US as the standard currency.

Workday Benefits Communication and Awareness

Workday Benefits has proven its worth as an efficient means of administering staff plans in many organisations that outsource their human resource (HR) processes.

Therefore, when Workday Benefits was introduced in 2022 and again in 2024, they needed to be well-prepared for it.

Amounts initially tracked by employees through the vendor application were later reflected in Workday Benefits, as outlined in the Workday Benefits tutorial in Bengaluru.

Unfortunately, complications arose when it was decided to transfer these figures directly into Workday Benefits while maintaining control over employees’ selections.

Reliable and Uninterrupted Workday Benefits Integration

Professionals play an invaluable role in the data migration from vendor systems to Workday Benefits, offering additional protections against employees as they complete data entry steps for variations or new sign-ups of plans, which still leave settings in place before unchecked selections are allowed.

This further emphasises the necessity of proper setup and execution.

2024 saw a pivotal moment as organisations agreed to retain amounts in Workday Benefits as an efficient method for profit management and employee convenience.

Overview of Workday Payroll Benefits

Workday Benefits can also assist employees with payroll management.

Employees can utilise Workday Benefits to view and deduct their pay through HR departments or outsource this task with third-party payroll providers such as ADP.

A key feature covered in the Workday Benefits tutorial in Bengaluru is how Workday Benefits delivers a comprehensive benefits package along with investor selection in a single, convenient package.

Employees receive specific budget items, while the Benefits Committee handles taxation duties.

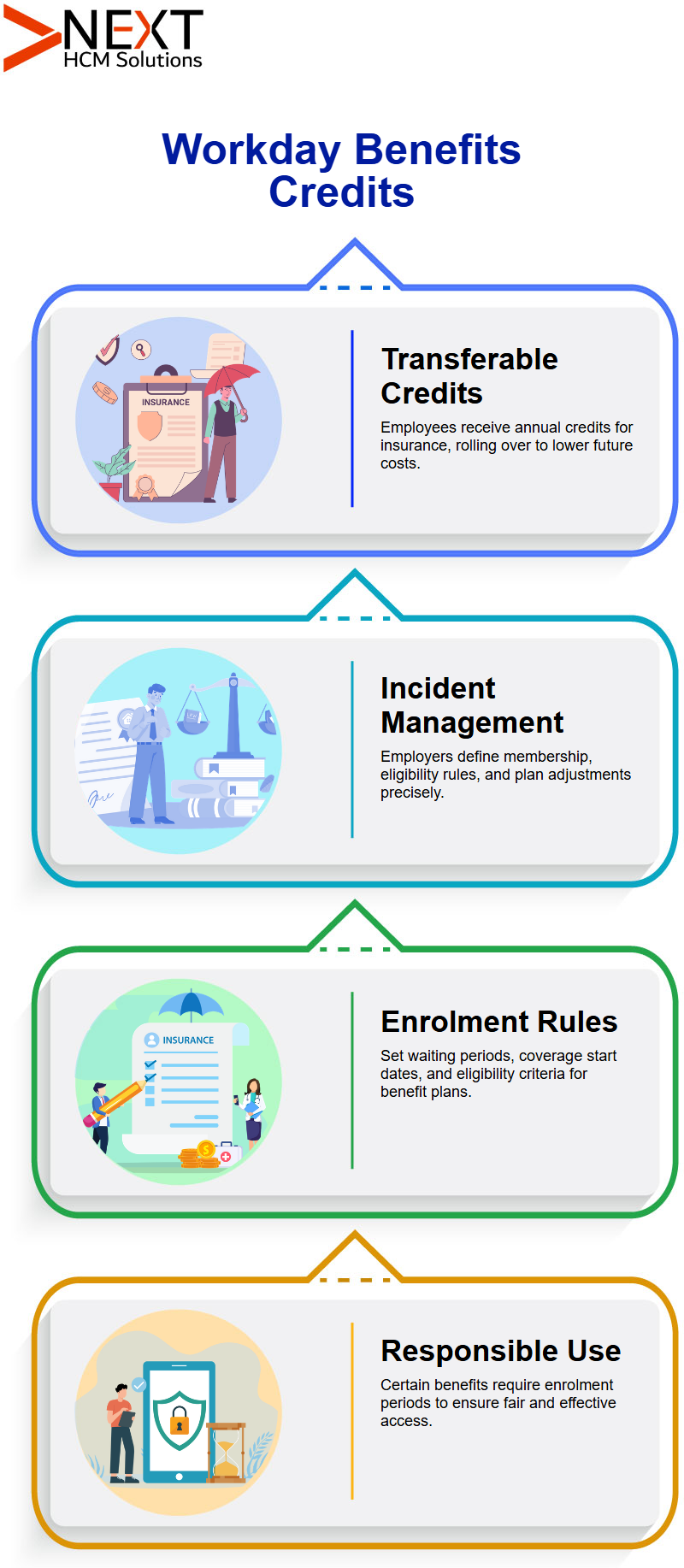

How Advantage Credits Work in Workday Benefits?

Workday Benefits’ transferable credits offer employees financial benefits.

For example, companies could provide employees with annual credits worth $1,000 toward insurance premiums that roll over into subsequent years, thereby lowering overall costs.

Consider how, in the Workday Benefits tutorial in Bengaluru, Workday Benefits serves as an example where employees without claims could qualify for a no-claim discount in future instances, helping to ensure they maintain coverage without jeopardizing their financial stability.

Managing Incidents within Workday Benefits

Starting up Workday Benefits requires employers to address key events with extreme precision, from characterising membership details, allocating plans, and adjusting eligibility standards, all the way down to designing eligibility rules and modifications for eligibility purposes.

Workday Benefits streamlines the process of using standard insurance names for staff, making it easier for them to explore and select coverage plans, as well as monitor coverage timelines for employees.

Enrolment Policies and Priority Rules for Workday Benefits

Employers use Workday Benefits enrolment rules as the cornerstone of merit inclusiveness.

During the Workday Benefits tutorial in Bengaluru, employers are guided on setting waiting periods, start dates of coverage, and eligibility requirements in Workday Benefits for enrolling employees in benefits plans.

Example: Utilising Workday Benefits’ gym equipment may require completing an enrolment period before use; this ensures the asset is used responsibly.

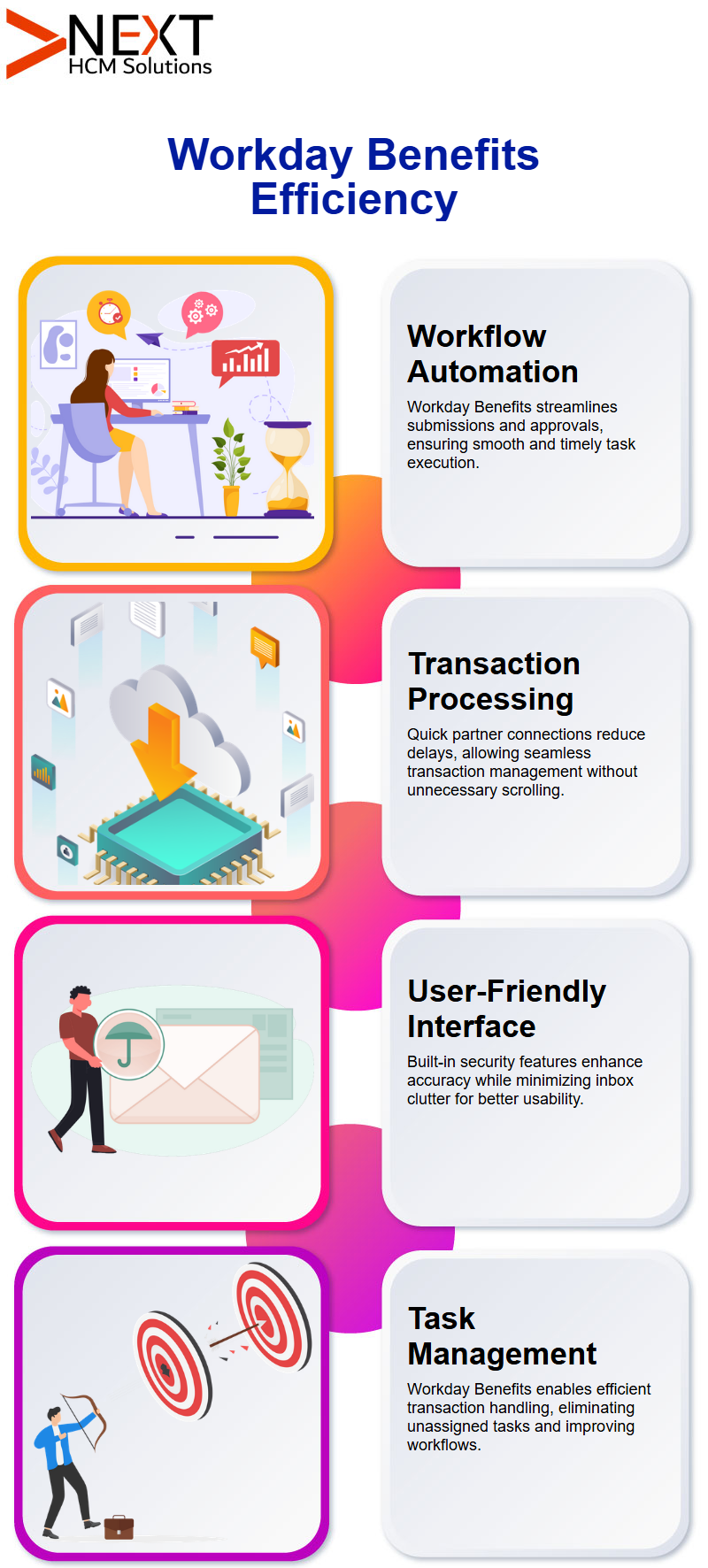

Streamlining Employee Processes within Workday Benefits

Workday Benefits has made managing employee workflows an effortless process.

Within the next fortnight, our focus should be on enhancing submissions and obtaining approvals efficiently to ensure the timely execution of workflows.

It stands out as a key feature due to its efficient transaction processing capability, with partner connections taking only seconds to set up, eliminating the need to scroll through pages to access relevant partners.

By participating in the Workday Benefits tutorial in Bengaluru, you’ll understand how Workday Benefits simplifies the workflow, cutting out unnecessary steps and preserving valuable time for everyone involved.

It ensures data accuracy and task allocation is correct while employing its built-in security features, providing users with a user-friendly experience that reduces delays caused by guardian transactions.

The last element of its user-friendly interface, which can operate as a proxy for others to facilitate transactions, makes an inbox clutter-free and guarantees accurate transaction processing times.

Organising Transaction Operations within Workday Benefits

Workday Benefits enables users to manage ongoing transactions efficiently and conveniently, allowing for easy approval or amendment of current tasks as needed.

If there are too many tasks pending completion, it’s helpful to cancel unnecessary ones to ensure smooth operations.

It provides unparalleled flexibility through pre-configured tenant data.

This adaptation enables effortless navigation through processes, facilitating uninterrupted task completion without interruptions or surprises.

It can help resolve issues related to unassigned tasks quickly and efficiently, allowing work to continue uninterrupted and without delay.

As emphasized in the Workday Benefits tutorial in Bengaluru, employees will be able to work more efficiently, with all problems addressed without delay.

Enhancing Productivity through Workday Benefits

Workday Benefits can be a valuable resource in enhancing productivity at the workplace.

Each of its functions, from tracking submissions and verifying receipt, performs with uncompromising precision and exactitude.

Employees can utilise Workday Benefits and harness them more effectively for task performance.

By eliminating repetitive activities, teams can focus on essential work rather than less critical duties.

The evolution of Workday Benefits alongside growing companies, including feature expansion and performance optimisation, is a key focus of the Workday Benefits tutorial in Bengaluru.

Due to its availability and dependability, Workday Benefits is now considered an indispensable component of modern workplace environments.

Elevating Employee Benefits through Workday

Workday Benefits provides employers and employees with a powerful platform for efficiently and conveniently administering employee benefits, creating tailored plans that are straightforward and designed explicitly for them.

Effective planning ensures that employees choose coverage that is explicitly tailored to their individual needs.

Configuring Optimal Plans in Workday Benefits

Establishing Workday Benefits involves proposing the plan.

Tasks involve coverage types, eligibility factors, and enrollment solutions.

Employees learn in the Workday Benefits tutorial in Bengaluru that Workday Benefits enables them to choose self-service courses or partner services to implement plans.

Workday Benefits: Clarity Coverage Types

Workday Benefits’ extensive coverage plays a crucial role.

Staff members can utilise it as an accessible method to access their benefits, helping ensure transparency when allocating upside allocation.

Workday Benefits simplifies enrollment for employees by providing precise enrollment dates, ensuring they’re aware of when their coverage will commence, and eliminating the need for staff inquiries regarding coverage dates or eligibility requirements.

Managing Default and Removed Plans in Workday Benefits

Workday Benefits can play a crucial role in both defaulting profit plans for employees and modifying them as needed.

Administrators can achieve smooth profit management by adhering to guidelines, as emphasized in the Workday Benefits tutorial in Bengaluru.