Join the Best Workday Training in Bengaluru to Learn, Practice and Suceed

Workday Benefits Training in Bengaluru

Training Blueprint

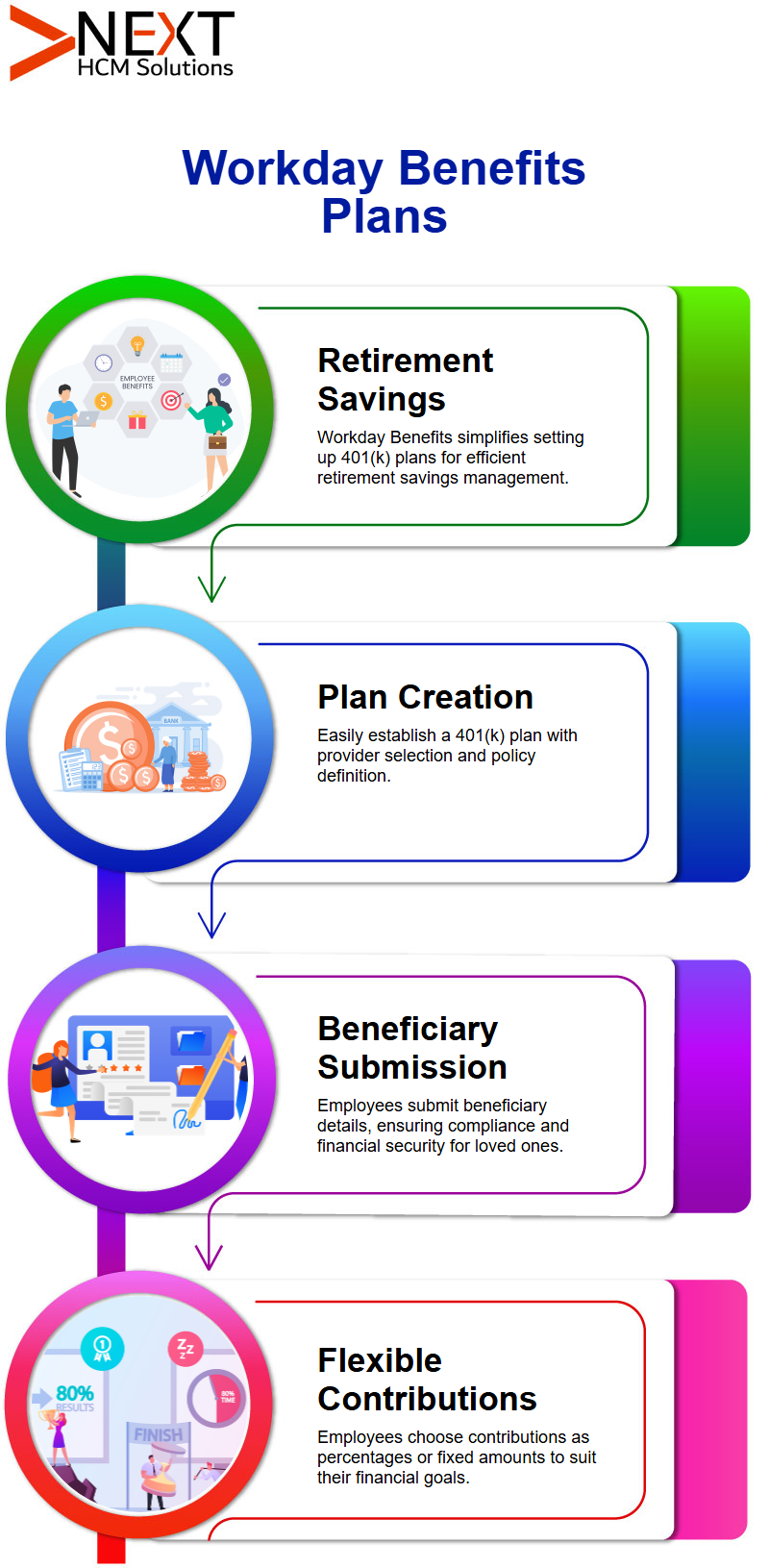

Workday Benefits: Introducing the Provision of Retirement Savings

Workday Benefits will be discussed as the platform of choice for efficiently organising retirement perk plans, utilising Workday Benefits 401(k) plans, as we explore their functions and steps for establishment.

Create your 401(k) profit plan easily with Workday Benefits’ user-friendly tool.

After selecting a provider and listing them as providers, listing coverage types, defining policy rules and following general company procedures.

Next comes creating value plans, followed by setting up routing occasions, open enrollment enrollments, and technician plans. It all happens seamlessly and in sequence.

As part of setting up our 401(k) plans, personnel are guided through the process of submitting beneficiary information during the Workday Benefits Training in Bengaluru, ensuring compliance with Workday Benefits requirements.

This stage ensures they can rest easy knowing their loved ones won’t go without financial support should any unexpected incidents arise.

Depending on the character the employee requires or desires from us for their plan design, we then select it accordingly, helping employees make informed choices when saving for retirement or making investment decisions.

Flexible Contribution Options and Enrolment Strategies using Workday Benefits

Workday Benefits allows companies to implement multiple contribution arrangements.

Contribution levels may be expressed either as percentages of salary or absolute amounts.

For example, employees could select from minimum contributions ranging from $10 to $100 monthly, either as an absolute amount or as a percentage, such as 16% of their pay, as their choice for participation in the plan.

Automatic enrolment, a key feature of Workday Benefits plans, is thoroughly covered in the Workday Benefits Training in Bengaluru, helping employers align features with their business priorities.

While some plans require employees to opt in themselves, others provide auto-enrolment features that enrol workers automatically based on business needs.

This setup gives companies more time and control in setting priorities according to what works for their workforce and employees alike.

The Value of Workday Benefits

Employees now have access to Workday plans, which enable them to easily make deposits and verify whether it increases employer benefits innovatively and exceptionally.

No matter if your contribution meets or surpasses the minimum threshold limits, Workday gives you the control you need over payroll deductions.

How Employee Contributions Work in Workday Benefits

Staff members have the option to contribute anywhere between 0% and 16% of their salary to their gain plan.

Employees who decide not to contribute can do so easily, as explained in the Workday Benefits Training in Bengaluru.

Conversely, should their employer contribute, staff are permitted to select and confirm a contribution percentage that suits them best.

Employer Contributions in Workday Benefits

Employers play an active role in Workday Benefits. An employer could commit to paying a certain percentage while workers select a part that corresponds with the assets owned.

In such a scenario, employees would focus on increasing the contribution rate from 50% to a higher level.

Payroll System Control over Workday Benefits

The payroll system’s primary function is to closely monitor workday benefits within the funding limitations of the Workday Benefits program, ensuring both legal compliance and adherence to the annual funding restrictions set by Workday Benefits.

When employees have reached annual limits, they won’t exceed the contribution threshold.

Payroll adjustments automatically restrict further deductions once the maximum threshold is reached, a key point highlighted during the Workday Benefits Training in Bengaluru.

Ensuring Accuracy in Workday Benefits Configuration

Deciphering Workday benefits can be complex for employees who do not receive a clear plan, as misconfiguration or ineligibility for plans may present obstacles.

When providing effective dates, it should show any planned benefits that should have been created for that employee.

Verifying employee eligibility should be the starting point for troubleshooting Workday Benefits successfully.

A check should be run regardless of whether an employee is full-time, salaried, or located outside the United States.

As highlighted in the Workday Benefits Training in Bengaluru, Workday Benefits may still contain errors despite all parameters being thoroughly followed and staff adhering to all output specifications.

One of the most crucial considerations when using Workday Benefits is accurately understanding profit results.

Employees must ensure their category is accurately represented when checking eligibility.

Otherwise, if an employee is miscategorised as either hourly pay or salaried, they could find accessing Workday Benefits restricted.

Resolving Access Issues in Workday Benefits

A Workday Benefits analysis must also consider a person’s primary address as one factor in determining eligibility.

For example, U.S. citizens without a registered address in the United States cannot access Workday Benefits.

Providing one’s home address is part of this eligibility identification process.

Proxy settings and job properties that do not exist could prevent employees from accessing Workday Benefits, an issue addressed in the Workday Benefits Training in Bengaluru.

After reviewing profiles and rules that interpret eligibility, and still experiencing difficulty accessing Workday Benefits, customers may seek assistance to resolve their problems.

Effectively establishing Workday Benefits is of vital importance.

In particular, default plans of default should be assigned only to employees who are eligible to receive them, making it impossible for other workers to waive them.

Managing Dependent Allocations and Configuration in Workday Benefits

Workday Benefits has also approved family (dependent) allocations, which involve assigning specific benefits to family members.

Employee and child distributions are carried out correctly to avoid asset errors.

Resolving Workday Benefits issues requires immense dedication, time, and careful analysis of all its aspects, with employee classification and system settings highlighted as key components in the Workday Benefits Training in Bengaluru when devising practical solutions.

By scrutinising configuration options carefully, employees can secure their rights while taking an active approach towards the responsible use of Workday Benefits.

Comprehension Workday Benefits

Workday benefits provide employees with essential resources and tools.

Employees leaving an organisation should be aware that they can continue to access all benefits through Workday, even after they leave, a feature all Workday users are likely familiar with.

Once upon a time, managing Workday Benefits required extensive manual efforts and time-consuming procedures.

Still, recent releases and insights from the Workday Benefits Training in Bengaluru have made it far simpler.

In some instances, involving dismissals not caused by the employee themselves, certain benefits may still be applicable and can even be granted, as benefits are distributed based on eligibility rules.

It empowers partners to perform the task of identifying eligible candidates without human involvement, not only streamlining but extending the period during which employees still receive benefits post-termination, allowing enough time to find work that meets their conditions.

Settlements are processed more quickly, and administrative hurdles are significantly reduced.

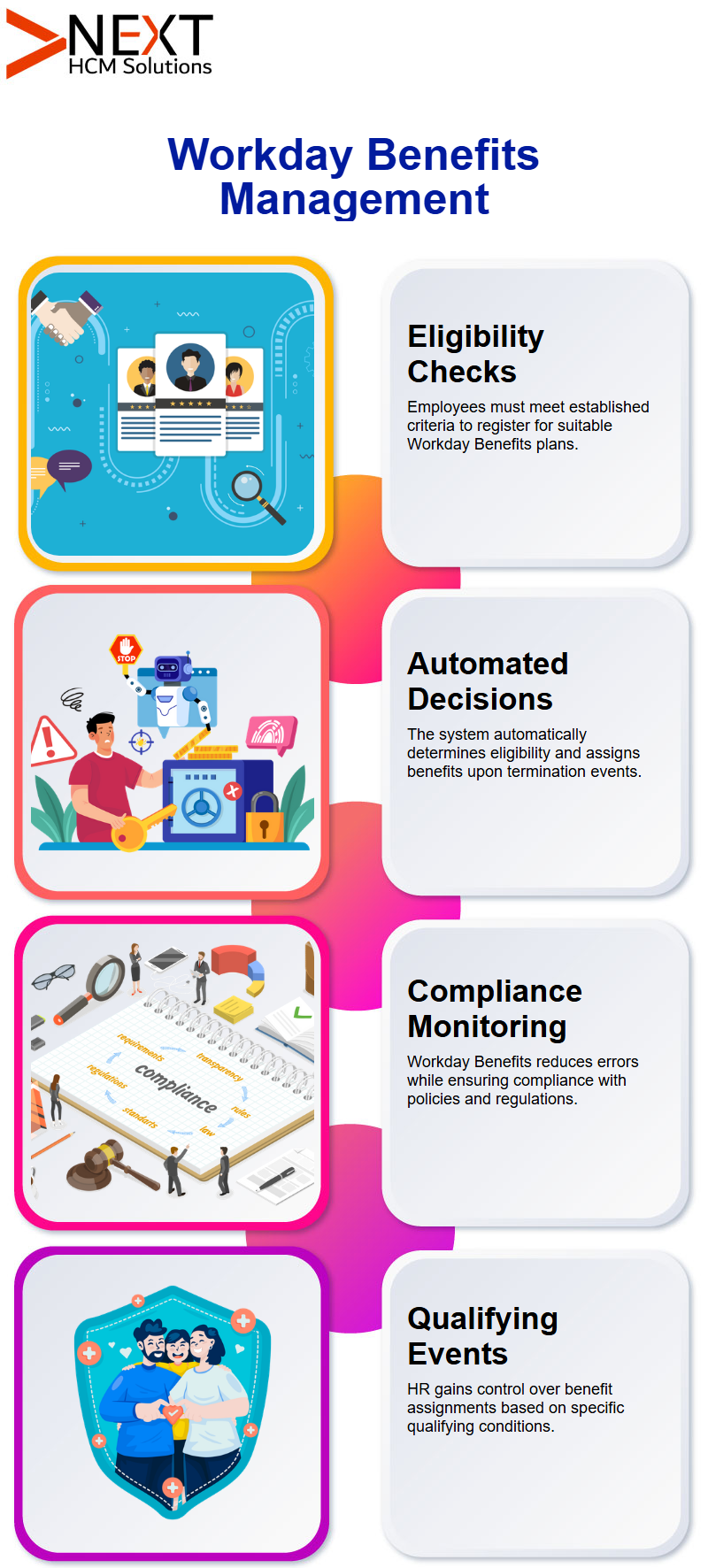

Workday Benefits Upside Eligibility Procedure

The first step to taking advantage of Workday Benefits is identifying eligible employees.

Even workers whose employment was terminated under certain conditions may still qualify for an enhanced benefits package in healthcare areas, specifically.

The process involves verifying predefined factors to establish eligibility in the Workday Benefits system and enrolling employees into the appropriate plans if they meet the specified conditions.

Eligibility was once conducted entirely manually with multiple requirement groups before the automation features were introduced in Workday Benefits, as explained in the Workday Benefits Training in Bengaluru.

However, now much of it can be automated, allowing HR teams to have more time and energy available for verifying employees through precise and well-timed presentations of benefits packages.

The Subject Matter of Workday Benefits Coverage

As soon as an employee is terminated, Workday Benefits coverage should be appropriately set up by established rules and eligibility checks.

HR teams learn through the Workday Benefits Training in Bengaluru how to effectively administer benefits in accordance with the rules defined in Workday Benefits itself.

Termination incidents mark the starting point of an automated decision process, wherein a system automatically determines if a profit meets certain rules and whether a specific person meets them.

When this condition exists, their employee can then be registered into their ideal Workday Benefits plan.

It has revolutionised our process for assigning work and monitoring compliance for specific coverage types, leading to a decrease in errors while simultaneously offering employees timely support when required.

Refining Workday Benefits Management

Administrators of Workday Benefits would likely experience increased joy and satisfaction.

What once felt daunting has now become accessible.

HR teams now need to not only assign benefits smoothly but also ensure compliance with company policies and regulations.

Complete control over qualifying events is a key feature of Workday Benefits, as detailed in the Workday Benefits Training in Bengaluru.

Furthermore, its auto-continuation mode, based on specific settings, ensures there will be no doubt as to who receives benefits.

Workday Benefits streamlines the process of assigning benefits and hosting registration events, making them more straightforward for HR staff and workers by reducing the complexity and stress associated with transitions.

Next in the Workday Benefits Change

Workday Benefits is an advanced system that promotes consistent and efficient processes while emphasising automation.

Furthermore, its structure ensures that employees receive coverage according to their eligibility and preset conditions.

Before Workday Benefits came along, HR professionals struggled to grant employees benefits when needed, and when employees left, coverage often had gaps that went unpaid for.

Retroactive Asset Assignment Processes make this task far simpler.

Companies implementing Workday Benefits automation not only ensure compliance with regulatory norms but also reduce administrative workload for both their employees and HR teams, as emphasised in the Workday Benefits Training in Bengaluru, ultimately benefiting both parties.